M&I Mineral Resource Estimate Increased to 51.3Mt at 66g/t Ag and 0.79g/t Au & Does Not Include New High-Grade Silver Discovery in Southwest Zone at Diablillos

Toronto - November 03, 2022: AbraSilver Resource Corp. (TSX.V:ABRA; OTCQX: ABBRF) ("AbraSilver" or the “Company”) is pleased to announce an updated, conceptual open pit constrained, Mineral Resource estimate for the Oculto deposit on the Company’s wholly-owned Diablillos property in Salta Province, Argentina. The Mineral Resource estimate is based on a total of 104,888 metres of drilling in 457 holes.

Highlights of the October 2022 Mineral Resource Estimate:

- Substantial growth in Measured & Indicated (“M&I”) Mineral Resources: 51.3Mt at 66g/t Ag and 0.79g/t Au for contained 109Moz silver and 1.3Moz gold, a 22% increase in contained silver and a 29% increase in contained gold over the September 2021 estimate

- Demonstrates a large, near-surface, potentially open pittable high-grade silver-equivalent (“AgEq”) Mineral Resource base at Diablillos: 51.3Mt at 131g/t AgEq with +215Moz AgEq

- 135% increase in tonnage of the high-grade zone, classified in the Measured category, now totaling 19.3Mt at 98g/t Ag & 0.88g/t Au

- US$5.1M Phase II drill program added 43Moz AgEq contained in the M&I Mineral Resource, representing an impressive cost of only US$0.12 per ounce AgEq added

- Extensive Mineral Resource growth potential remains: Ongoing Phase III drill program focused on expanding the recent high-grade silver discovery in the Southwest zone, for which a maiden Mineral Resource estimate is expected in H1/2023

John Miniotis, President and CEO, commented, “Our team first started drilling the Diablillos project less than three years ago, and within that short timeframe we have successfully transformed a formerly dormant property into one of the highest-quality, potentially open-pittable, undeveloped primary silver projects in the world. We are delighted to announce that M&I Mineral Resources now include over 215 million ounces AgEq, with additional growth potential exploration, especially from the newly discovered high-grade silver intercepts in the Southwest zone currently being drilled.

Importantly, our exploration team has once again demonstrated the ability to add significant value in a very cost-effective manner. Overall, we spent US$5.1M in exploration drilling at Diablillos in our Phase II drill program, which resulted in an impressive cost of only US$0.12 per contained ounce of AgEq added to the new M&I Mineral Resource Estimate.”

David O’Connor, Chief Geologist, stated, “Our Phase II drilling was highly successful in expanding our M&I Mineral Resource base for the Oculto deposit. In particular, the high-grade Tesoro zone, which is included in the Measured category, now totals 19.3Mt at 98g/t Ag & 0.88g/t Au, containing over 105Moz AgEq, representing a 95% increase compared to last year’s Mineral Resource estimate.

Looking forward, the exploration outlook is bright at the Diablillos project. Ongoing drilling in the Southwest zone has the potential for substantial growth in silver resources, as the new zone displays potential for district-scale, high-grade, near-surface, silver mineralization. We are very excited about the future potential of the Diablillos project, where we continue to see significant opportunities to further expand Mineral Resources in a highly cost-effective manner.”

October 2022 Mineral Resource Estimate

Table 1 – Oculto Mineral Resource Estimate – As of October 31, 2022

| Zone |

Category |

Tonnes

(000 t) |

Ag

(g/t) |

Au

(g/t) |

AgEq

(g/t) |

Contained

Ag

(k oz Ag) |

Contained

Au

(k oz Au) |

AgEq

(k oz AgEq) |

| Oxides |

Measured |

18,092 |

101 |

0.85 |

171 |

58,655 |

496 |

99,280 |

| Indicated |

30,226 |

49 |

0.71 |

107 |

47,502 |

688 |

103,852 |

Measured &

Indicated |

48,318 |

68 |

0.76 |

130 |

106,157 |

1,184 |

203,132 |

| Inferred |

2,090 |

31 |

0.50 |

72 |

2,085 |

33 |

4,788 |

| Transition Zone |

Measured |

1,244 |

50 |

1.21 |

149 |

1,979 |

49 |

5,992 |

| Indicated |

1,752 |

22 |

1.13 |

115 |

1,235 |

64 |

6,477 |

Measured &

Indicated |

2,996 |

33 |

1.17 |

129 |

3,214 |

113 |

12,469 |

| Inferred |

127 |

7 |

0.80 |

73 |

29 |

3 |

275 |

| Total |

Measured |

19,336 |

98 |

0.88 |

170 |

60,634 |

544 |

105,190 |

| Indicated |

31,978 |

47 |

0.73 |

107 |

48,737 |

752 |

110,329 |

Measured &

Indicated |

51,314 |

66 |

0.79 |

131 |

109,370 |

1,297 |

215,520 |

| Inferred |

2,216 |

30 |

0.51 |

72 |

2,114 |

37 |

5,144 |

Notes for October 2022 Mineral Resource Estimate:

- Mineral Resources are not Mineral Reserves and have not demonstrated economic viability.

- The Mineral Resource is reported inside a conceptual Whittle open pit shell derived using US $25.00/oz Ag price, US $1750/oz Au price, 73.5% process recovery for Ag, and 86% process recovery for Au. The constraining open pit optimization parameters used were $3.00/t mining cost, $24.45/t processing cost, $2.90/t G&A cost, and average 54-degree open pit slopes.

- The formula for calculating AgEq is as follows: Silver Eq Oz = Silver Oz + Gold Oz x (Gold Price/Silver Price) x (Gold Recovery/Silver Recovery)

- The Mineral Resource Estimate has been categorized in accordance with the CIM Definition Standards (CIM, 2014).

- All figures are rounded to reflect the relative accuracy of the estimates. Minor discrepancies may occur due to rounding to appropriate significant figures.

- The Mineral Resource was estimated by Mr. Peralta, B.Sc., FAusIMM CP(Geo), an independent Qualified Person within the meaning of NI 43-101.

- The mineralisation estimated in the Mineral Resource is sub-horizontal with sub-vertical feeders and a reasonable prospect for eventual economic extraction by open pit methods.

- A cut off grade of 35 gt AgEq was used for the Mineral Resource

- The Mineral Resource models used Ordinary Kriging grade estimation within a three-dimensional block model and mineralized zones defined by wireframed solids, which are a combination of lithology and alteration domains. Constrained by a Whittle open pit shell. The 1m composite grades were capped where appropriate.

- All tonnages reported are dry metric tonnes and ounces of contained gold and silver are troy ounces.

- In-situ bulk density were assigned to each model domain, according to sample averages of each lithology domain, separated by alteration zones and subset by oxidation.

- Mining recovery and dilution factors have not been applied to the Mineral Resource estimates.

- Mr. Peralta is not aware of any environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues that could materially affect the potential development of the Mineral Resource.

- Totals may not agree due to rounding.

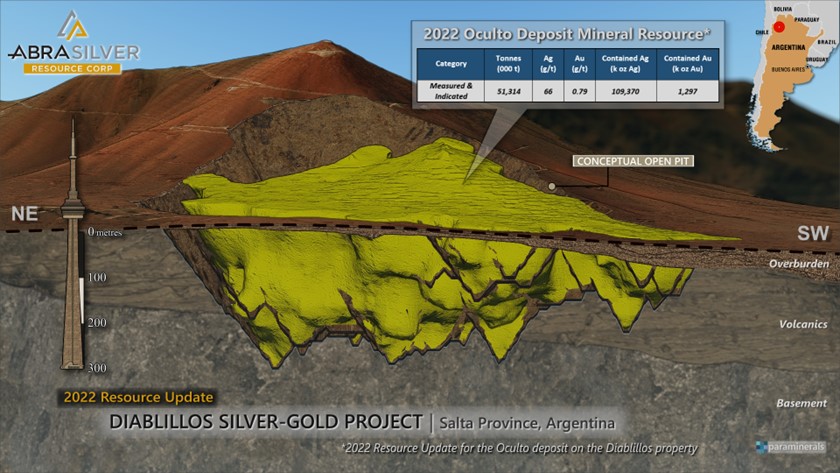

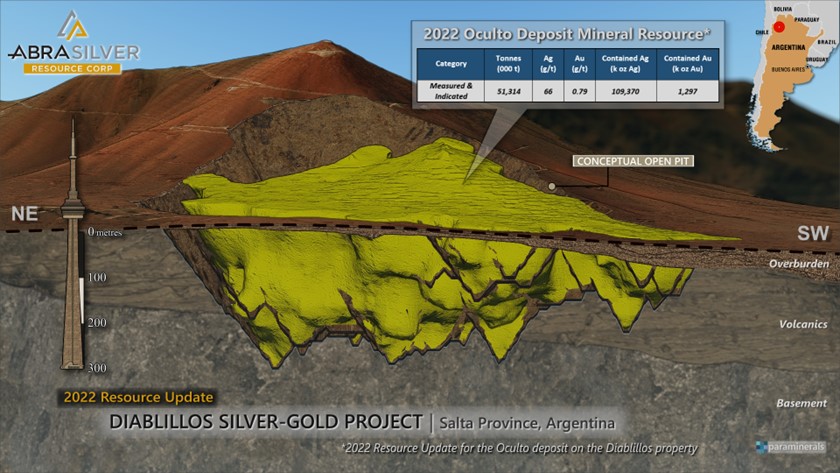

Figure 1 – Visualization of October 2022 Mineral Resource Estimate at Oculto Deposit

October 2022 Mineral Resource Estimate

The October 2022 Mineral Resource estimate was completed by Luis Rodrigo Peralta, B.Sc., FAusIMM CP(Geo), Independent Consultant, in accordance with Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards incorporated, by reference, and in compliance with National Instrument NI 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”), and has been reviewed internally by AbraSilver. The October 2022 Mineral Resource estimate is the result of 104,888 metres of drilling in 457 drill holes. The Mineral Resource is based only on the Oculto deposit within the broader Diablillos property and is reported inside a Whittle open pit shell with a cutoff grade of 35g/t silver equivalent, based on the economic parameters outlined in the Supporting Technical Disclosure section below.

Gold and silver grades were estimated into the block model using Reverse Circulation Drill holes (RC), Diamond Drill holes (DDH) including the recent drilling between 2019 to July 30th, 2022. It was estimated applying industry-standard estimation methodology: Ordinary Kriging (OK) and bias was reviewed using an Inverse Distance squared estimate (ID2) for comparison. Drill hole intervals have been composited to a length of 1 m, which is the average sampling length for core sampling. Grade capping has been applied to composited grade intervals on a case-by-case basis within each estimation domain. The estimation domains were defined using a combination of lithology domains, alteration domains, and oxide / sulphides state, defining a set of 18 domains for gold and silver.

Significant Exploration Upside Potential

The October 2022 Mineral Resource estimate includes drill data as of July 30, 2022. Subsequent to this cut-off date, the Company has already drilled an additional 27 holes, or approximately 6,000 metres, as part of the ongoing Phase III drill program. As previously announced, the Company has recently discovered a brand-new exploration target (the JAC target), located several hundred metres beyond the southwestern limit of the October 2022 Mineral Resource estimate at Oculto. To date, assay results received for the initial three drill holes from the new JAC target in the Southwest zone have demonstrated high-grade silver mineralization in near-surface oxide mineralization over broad widths, with excellent potential for continuity based on magnetics and geological interpretation. The new Southwest zone (JAC target) adds a brand-new dimension to the Diablillos project and opens up considerable silver resource potential beyond the October 2022 Mineral Resource estimate.

The Company currently has two drill rigs actively exploring the Southwest zone (JAC target) and expects to announce a maiden Mineral Resource estimate for this new zone in H1/2023.

Geology

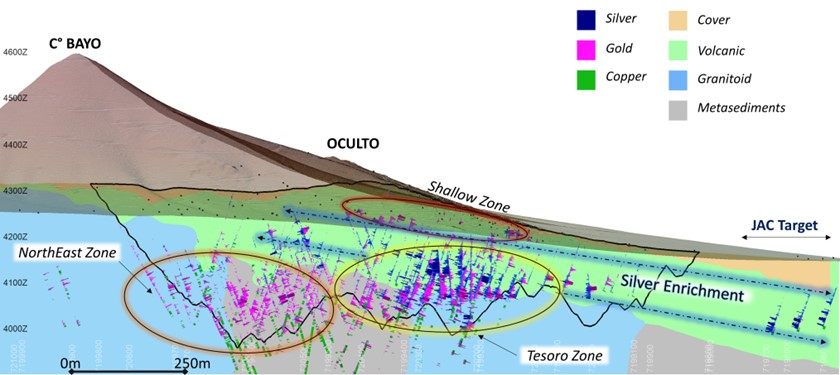

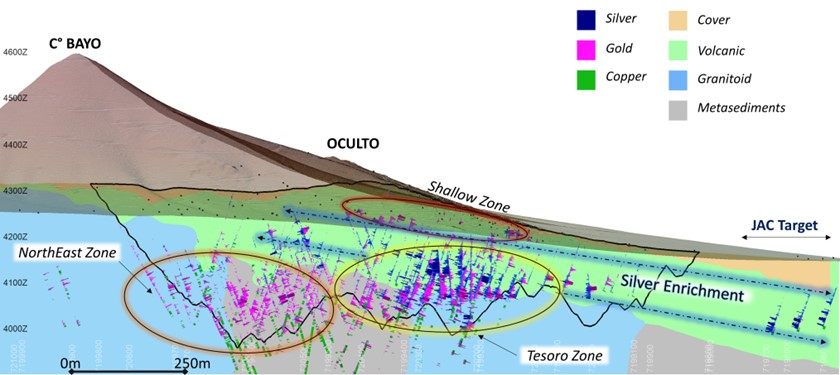

The Diablillos property hosts several zones of high-sulphidation epithermal alteration and mineralization with strong supergene overprinting. There are several known mineralized zones on the Diablillos property, with the Oculto zone hosting the principal silver-gold deposit. Oculto is strongly oxidized down to depths in the order of 300 m to 400 m from surface. The precious metal mineralization throughout the deposit occurs as extremely fine grains along fractures and in breccias or coating the inside of vugs and weathered cavities. The dimensions of the optimised Whittle open pit shell measure 1,350 metres in length, 750 metres in width and extends to a maximum depth of approximately 300 metres.

Gold and silver mineralization ascended along steeply dipping feeder structures and was deposited in siliceous breccia zones. Mineralizing fluids also migrated laterally along shallowly dipping favorable permeability horizons where it was deposited along with silicification. Gold is associated with a deeper permeability horizon and with shallow zones associated with the feeder structures, while there is a secondary enriched silver zone related to a weathered horizon. Both steeply dipping and shallowly dipping zones were taken into account in the new Mineral Resource estimate.

The October 2022 Mineral Resource has significantly expanded the high-grade Tesoro zone, which is the highest-grade area within the Oculto deposit. A series of close-spaced drill holes has resulted in the Tesoro zone expanding to approximate dimensions of 600 metres in length by 350 metres in width, comprising estimated Measured Resource of 19.3Mt @ 98 g/t Ag and 0.88 g/t Au, containing 60.6Moz Ag and over 544koz Au. This represents an increase of 85% in contained silver and 110% in contained gold in the Measured category compared to the Mineral Resource estimate announced by the Company on September 15, 2021.

Figure 2 – Long Section Highlighting Various Mineralized Zones at Oculto & New JAC Target

Mineral Resource Estimate Sensitivity

A table showing sensitivities to the cut-off grade for the October 2022 Mineral Resource in the Measured and Indicated category is provided below.

Table 2 – Cut-Off Grade Sensitivity of Measured & Indicated Mineral Resources (Oxide & Transition zone)

Cut Off

(AgEq) |

Tonnage Oxides

(000 t) |

Silver Grade

(g/t) |

Gold Grade

(g/t) |

Silver Equivalent Grade

(g/t) |

| 10 |

105,215 |

38 |

0.44 |

75 |

| 20 |

75,228 |

50 |

0.58 |

98 |

| 30 |

57,492 |

61 |

0.72 |

120 |

| 35 |

51,314 |

66 |

0.79 |

131 |

| 40 |

46,206 |

71 |

0.85 |

141 |

| 50 |

38,212 |

81 |

0.96 |

160 |

| 60 |

32,254 |

91 |

1.07 |

179 |

Supporting Technical Disclosure

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The Mineral Resource incorporates geological and structural constraints and is constrained by an optimized Whittle open pit containing a total of 51.3 Mt of M&I Mineral Resource and 234.0 Mt of waste.

- Individual metals are reported at 100% of in-situ grades.

- Sensitivity cut-offs reported are a subset of the in-pit Mineral Resource.

- The effective date of the Mineral Resource is October 31, 2022, and is based on drilling through July 30th, 2022.

- There are no known legal, political, environmental or other risks that could materially affect the potential development of the Mineral Resource.

- Key Assumptions are outlined below (all figures are in US dollars unless otherwise noted):

- Commodity prices:

- Note: Commodity price assumptions were guided by the NI 43-101 requirement for the Mineral Resource to have ‘reasonable prospects’ of eventual economic extraction.

- Metallurgical recoveries: metallurgy recoveries were assumed as 73.5% for silver and 86% for gold, as demonstrated in the Company’s Preliminary Economic assessment in respect of the Diablillos property dated January 13, 2022.

- Operating cost assumptions: Mining costs of $3.00/t; processing costs of $24.45/t; and G&A costs of $2.90/t.

- Open pit slopes: Open pit shell slope angles have been re-designed, based on recent geotechnical drilling and modelling. Six geotechnical sectors have been defined. The average inter-ramp angle assumed for open pit shell generation was 54 degrees.

- The formula for calculating AgEq is as follows: Silver Eq Oz = Silver Oz + Gold Oz x (Gold Price/Silver Price) x (Gold Recovery/Silver Recovery)

- A full Technical Report in respect of the October 2022 Mineral Resource will be prepared in accordance with NI 43-101 and will be filed on SEDAR within 45 days of this news release.

QA/QC and Core Sampling Protocols

AbraSilver applies industry standard exploration methodologies and techniques, and all drill core samples are collected under the supervision of the Company’s geologists in accordance with industry practices. Drill core is transported from the drill platform to the logging facility where drill data is compared and verified with the core in the trays. Thereafter, it is logged, photographed, and split by diamond saw prior to being sampled. Samples are then bagged, and quality control materials are inserted at regular intervals; these include blanks and certified reference materials as well as duplicate core samples which are collected in order to assess sampling precision and reproducibility. Groups of samples are then placed in large bags which are sealed with numbered tags in order to maintain a chain-of-custody during the transport of the samples from the project site to the laboratory.

All samples are received by the SGS offices in Salta who then dispatch the samples to the SGS preparation facility in San Juan. From there, the prepared samples are sent to the SGS laboratory in Lima, Peru where they are analyzed. All samples are analyzed using a multi-element technique consisting of a four-acid digestion followed by ICP/AES detection, and gold is analyzed by 50g Fire Assay with an AAS finish. Silver results greater than 100g/t are reanalyzed using four acid digestion with an ore grade AAS finish.

Qualified Persons and Technical Information

The site visit, review of various geological aspects including sampling, drill core, logging, assay laboratory, independent check sample and October 2022 Mineral Resource estimate were done by Mr. Luis Rodrigo Peralta, B.Sc., FAusIMM CP (Geo). Mr. Peralta is an independent Qualified Person (“QP”) as defined by the NI 43-101. Mr. Peralta has reviewed and approved the technical content of this news release.

The full Technical Report, which is being prepared in accordance with NI 43-101 by Mr. Peralta, will be available on SEDAR (www.sedar.com) under the Company’s issuer profile within 45 days from this news release. The effective date of this Mineral Resource estimate is October 31, 2022.

Historical Silver-Equivalent Disclosure

Certain of the Company’s prior disclosure of AgEq at the Diablillos property did not take into account recovery information. The disclosure in this news release in respect of the AgEq at the Diablillos property supersedes and replaces all prior disclosure by the Company of AgEq at the Diablillos property. The Company’s revised reporting of AgEq to take into account recovery information was at the request of the Ontario Securities Commission and in connection with a continuous disclosure review of the Company.

About AbraSilver

AbraSilver is an advanced-stage exploration company focused on rapidly advancing its 100%-owned Diablillos silver-gold project in the mining-friendly Salta province of Argentina. The current Measured and Indicated Mineral Resource estimate for Diablillos consists of 51.3 Mt grading 66g/t Ag and 0.79g/t Au, containing approximately 109Moz silver and 1.3Moz gold, with significant further upside potential based on recent exploration drilling. The Company is led by an experienced management team and has long-term supportive shareholders including Mr. Eric Sprott. In addition, AbraSilver owns a portfolio of earlier-stage copper-gold projects including the La Coipita copper-gold project in the San Juan province of Argentina. AbraSilver is listed on the TSX-V under the symbol “ABRA” and in the U.S. under the symbol “ABBRF”.

For further information please visit the AbraSilver Resource website at www.abrasilver.com, our LinkedIn page at AbraSilver Resource Corp., and follow us on Twitter at www.twitter.com/abrasilver

Alternatively please contact:

John Miniotis, President and CEO

[email protected]

Tel: +1 416-306-8334

Cautionary Statements

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. All statements that address future plans, activities, events or developments that the Company believes, expects or anticipates will or may occur are forward-looking information. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. When considering this forward-looking information, readers should keep in mind the risk factors and other cautionary statements in the Company’s disclosure documents filed with the applicable Canadian securities regulatory authorities on SEDAR at www.sedar.com. The risk factors and other factors noted in the disclosure documents could cause actual events or results to differ materially from those described in any forward-looking information. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release