Toronto - March 24, 2025: AbraSilver Resource Corp. (TSX:ABRA; OTCQX: ABBRF) ("AbraSilver" or the “Company”) is pleased to announce the commencement of a 20,000 metre (“m”) Phase V diamond drilling program on its wholly-owned Diablillos property in Argentina (“Diablillos” or the “Project”). This new phase of exploration builds upon the highly successful Phase IV drill campaign, which identified significant high-grade silver and gold mineralization across multiple targets within the broader Diablillos land package.

Key Highlights

- Fully-funded 20,000 m program will primarily utilize three diamond drill rigs to drill approximately 90 holes and is expected to be completed by December 2025;

- Combination of infill and step-out drilling to further expand and upgrade the Mineral Resource estimate, with an updated Mineral Resource estimate anticipated in mid-2025. Some condemnation drilling will also be completed as part of the Definitive Feasibility Study work that is underway.

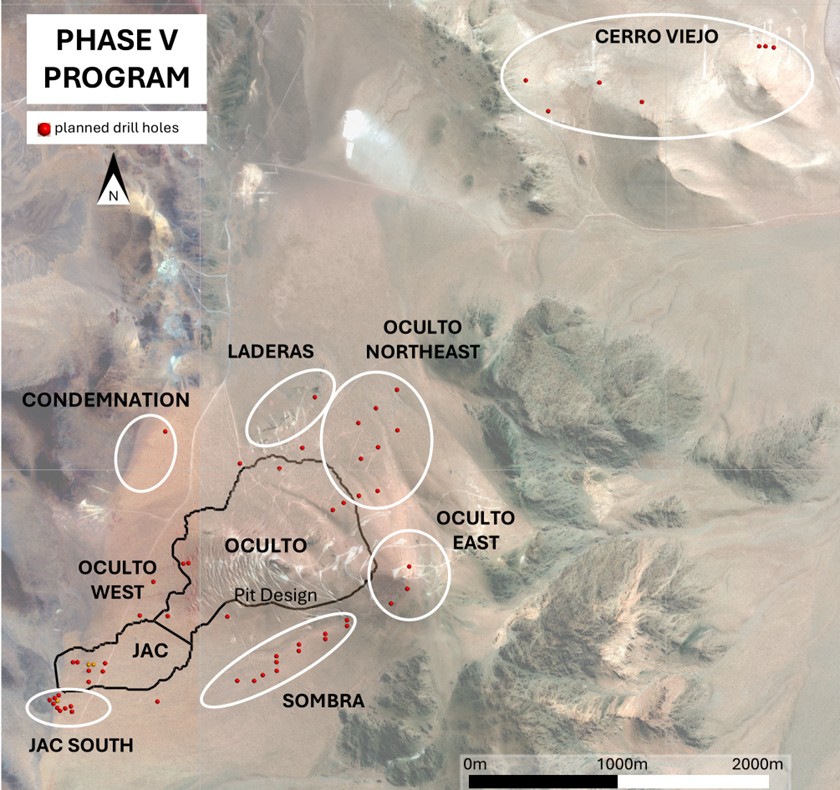

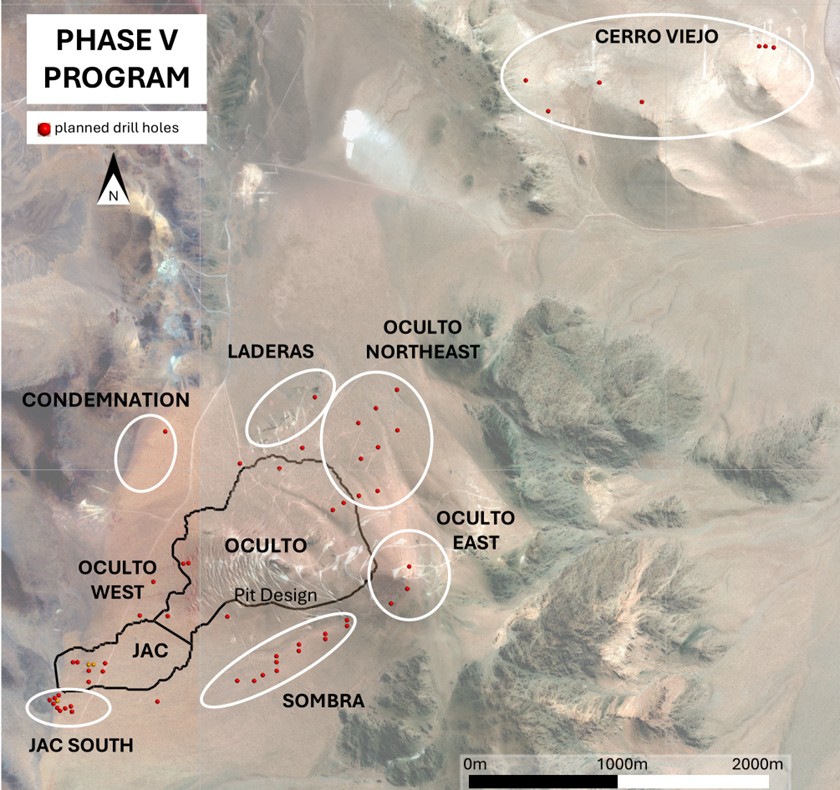

- Key drilling areas at Diablillos include:

- The Oculto-JAC epithermal district, focusing on JAC, JAC south extension, Sombra, Oculto Northeast, Oculto East, Oculto West, and Laderas targets.

- The northeast epithermal-porphyry complex, located approximately 4 km northeast of the main Oculto deposit, including the newly identified Cerro Viejo gold target, which remains largely underexplored.

John Miniotis, President and CEO, commented, “Following the strong results from our Phase IV drilling program and highly successful equity raise, we are excited to initiate this next phase of exploration at Diablillos. With multiple high-grade targets and a very robust financial position, we remain extremely well-positioned to continue to build long-term value for our shareholders.”

Dave O’Connor, Chief Geologist, commented, “The Phase V program is designed to systematically expand our known mineralized zones and assess new, high-potential exploration targets. In particular, the newly identified Cerro Viejo epithermal system has the potential to become a major discovery within the Diablillos district. With drilling already underway, we anticipate further substantial Mineral Resource growth that will enhance the long-term economics of the Project.”

High-Priority Exploration Targets

Phase V drilling is designed to strategically expand known high-grade mineralization and test additional high-priority targets across the broader Diablillos project area. Drilling activities have now commenced with two drill rigs currently active, and a third rig expected to arrive within the coming weeks.

Figure 1 – Phase V Exploration Key Target Areas

Key Target Areas:

- JAC South Extension: Phase IV drilling confirmed extensions of high-grade silver mineralization beyond current open pit margins. Additional drilling is planned to further expand this shallow, high-grade mineralized zone. Notable intercepts from Phase IV include

- DDH 24-018 with 31.5 m at 277 g/t Ag from a down-hole depth of 118 m, including 13.7 m grading 455 g/t Ag; and

- DDH 24-033 with 50.0 m at 250 g/t Ag from a down-hole depth of 110 m, including 5.0 m grading 1,036 g/t Ag.

- Sombra Zone – Newly Identified Discovery: The Sombra target is a promising parallel northeast-trending magnetic anomaly, located south of Oculto. Additional drilling is aimed to further evaluate the strike and width continuity of this shallow mineralized system. Notable intercepts include:

- DDH 24-069 with 17.0 m at 101 g/t Ag from a down-hole depth of only 38 m.

- Oculto Northeast – High-Grade Gold and Silver: Drilling along the northern margin of Oculto intersected high-grade gold and silver mineralization beyond the proposed open pit margin. Recent holes drilled in the area include:

- DDH 24-031 with 15.0 m grading 496 g/t Ag and 0.28 g/t Au from a down-hole depth of 152 m, including 5.7 m grading 1,151 g/t Ag and 0.22 g/t Au;

- DDH 24-070 with 17.0 m grading 1.80 g/t Au and 39 g/t Ag from a depth of 151 m, including a higher-grade interval of 4.4 m grading 3.30 g/t Au and 28 g/t Ag; and

- DDH 24-034 intersected several zones of shallower gold-silver mineralisation, with 18.0 m at 1.34 g/t Au and 17 g/t Ag from 81 m depth, which is predicted to extend north-eastwards.

- Oculto East – Newly Mapped Silver-Gold Structures: Drilling at Oculto East targeted newly mapped structures located 600 m east of Oculto. Additional drilling is planned to determine the direction and dimensions of these mineralized structures. Recent intercepts include:

- DDH 24-058 intersecting 24.5 m at 106.9 g/t Ag from a down-hole depth of 202 m, including 3.0 m at 465.3 g/t Ag; and

- DDH 24-064 intersecting 22.0 m at 2.78 g/t Au from a depth of 307 m, including 9.0 m at 5.35 g/t Au.

- Laderas – Potential Open-Pit Expansion: Drilling will evaluate potential mineral continuity between Laderas and Oculto. Two initial holes will test whether these zones could be combined into a potential single open pit.

- Cerro Viejo – Emerging High-Grade Gold Target: Interpreted as being part of a gold-rich epithermal system, located above a major porphyry intrusion. A major zone of multiple silicified veins extends for an east-west distance of more than one kilometre (“km”), where recent rock sampling returned significant gold values, validating the high-grade potential. The notable intercept from the initial hole at Cerro Viejo was:

- Hole DDH 24-056 intersected 36 m of 1.91 g/t Au starting at a depth of 87 m, including 5.0 m at 7.22 g/t Au

- Porphyry Complex – Large-Scale Discovery Potential: Initial geological mapping and reconnaissance drilling have identified intense pyrite veining and stockwork mineralization in dacite breccias, with accompanying gold mineralization. Additional geological and structural mapping, together with a magnetometer survey and PIMA studies are planned to refine drill targets before further reconnaissance drilling that is planned for later this year.

Note: All intercepts shown reflect drilled widths, not true widths.

About Diablillos

The Diablillos property is located within the Puna region of Argentina, in the southern part of Salta Province along the border with Catamarca Province, approximately 160 km southwest of the city of Salta and 375 km northwest of the city of Catamarca. The property comprises 15 contiguous and overlapping mineral concessions acquired by AbraSilver in 2016. The project site has good year-round accessibility through a 150 km paved road, followed by a well-maintained gravel road, shared with other adjacent projects.

There are several known mineral zones on the Diablillos property. Approximately 150,000 m have been drilled to date, which has outlined multiple occurrences of epithermal silver-gold mineralization at Oculto, JAC, Laderas and Fantasma. Several satellite zones of silver/gold-rich epithermal mineralization have been located within a 500 m to 1.5 km distance surrounding the Oculto/JAC epicentre. In addition, a large porphyry complex is centered approximately 4 km northeast of Oculto which includes outcropping porphyry intrusions within a major zone of alteration, and associated gold rich epithermal mineralization.

Comparatively nearby examples of high sulphidation epithermal deposits include: La Coipa (Chile); Yanacocha (Peru); El Indio (Chile); Lagunas Nortes/Alto Chicama (Peru) Veladero (Argentina); and Filo del Sol (Argentina). The most recent Mineral Reserve estimate for Diablillos is shown in Table 2:

Table 2 - Diablillos Mineral Reserve Estimate – As of March 07, 2024

| Category |

Tonnage

(000 t) |

Ag

(g/t) |

Au

(g/t) |

Contained Ag

(000 oz Ag) |

Contained Au

(000 oz Au) |

| Proven |

12,364 |

118 |

0.86 |

46,796 |

341 |

| Probable |

29,930 |

80 |

0.80 |

76,684 |

766 |

| Proven & Probable |

42,294 |

91 |

0.81 |

123,480 |

1,107 |

Notes for Mineral Reserve Estimate:

- Mineral reserves have an effective date of March 7th, 2024.

- The Qualified Person for the Mineral Reserve Estimate is Mr. Miguel Fuentealba, P.Eng.

- The mineral reserves were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), Definition Standards for Mineral Resources and Reserves, as prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council.

- The mineral reserves were based on a pit design which in turn aligned with an ultimate pit shell selected from a Whittle TM pit optimization exercise. Key inputs for that process are:

• Metal prices of USD $1,750/oz Au; USD $22.50/oz Ag

• Variable Mining cost by bench and material type. Average costs are USD $1.94/t for all lithologies except for “cover”. Cover mining cost of USD 1.73/t.

• Processing costs for all zone, USD $22.97/t. • Infrastructure and G&A cost of USD 3.32/t. • Pit average slope angles varying from 37° to 60° depending on the geotechnical domain. • The average recovery is estimated to be 82.8% for silver and 86.6% for gold.

- The Mineral Reserve Estimate has been classified in accordance with the CIM Definition Standards (CIM, 2014).

- A Net Value per block (“NVB”) cut-off was used to constrain the Mineral Reserve with the reserve pit 2shell. The NVB was based on "Benefits = Revenue-Cost" being positive, where, Revenue = [(Au Selling Price (USD/oz) - Au Selling Cost (USD/oz)) x (Au grade (g/t)/31.1035)) x Au Recovery (%)] + [(Ag Selling Price (USD/oz) - Ag Selling Cost (USD/oz)) x (Ag grade (g/t)/31.1035)) x Ag Recovery (%)] and Cost = Process Cost (USD/t) + Transport Cost (USD/t) + G&A Cost (USD/t) + [Royalty Cost (%) x Revenue]. The NVB method resulted in an average equivalent cut-off grade of approximately 46g/t AgEq.

- In-situ bulk density was read from the block model, assigned previously to each model domain during the process of mineral resource estimation, according to samples averages of each lithology domain, separated by alteration zones and subset by oxidation.

- All tonnages reported are dry metric tonnes and ounces of contained gold and silver are troy ounces.

- All figures are rounded to reflect the relative accuracy of the estimates. Minor discrepancies may occur due to rounding to appropriate significant figures.

QA/QC and Core Sampling Protocols

AbraSilver applies industry standard exploration methodologies and techniques, and all drill core samples are collected under the supervision of the Company’s geologists in accordance with industry practices. Drill core is transported from the drill platform to the logging facility where drill data is compared and verified with the core in the trays. Thereafter, it is logged, photographed, and split by diamond saw prior to being sampled. Samples are then bagged, and quality control materials are inserted at regular intervals; these include blanks and certified reference materials as well as duplicate core samples. Groups of samples are then placed in large bags which are sealed with numbered tags in order to maintain a chain-of-custody during the transport of the samples from the project site to the laboratory.

All samples are sent to the Alex Stewart sample preparation facility in Jujuy, then the sample pulps are sent to the Alex Stewart laboratory in Mendoza where they are analyzed. All samples are analyzed using a multi-element technique consisting of a four-acid digestion followed by ICP/AES detection, and gold is analyzed by 50g Fire Assay with an AAS finish. Silver results greater than 100g/t are reanalyzed using four acid digestion with an ore grade AAS finish.

Qualified Persons

Technical information in this news release has been approved by David O’Connor P.Geo., Chief Geologist for AbraSilver, and a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects.

About AbraSilver

AbraSilver is an advanced-stage exploration company focused on rapidly advancing its 100%-owned Diablillos silver-gold project in the mining-friendly Salta and Catamarca provinces of Argentina. The current Proven and Probable Mineral Reserve estimate for Diablillos, from a recently completed Pre-Feasibility Study, consists of 42.3 Mt grading 91 g/t Ag and 0.81 g/t Au, containing approximately 124 Moz silver and 1.1 Moz gold, with significant further exploration upside potential. In addition, the Company has entered into an earn-in option and joint venture agreement with Teck on the La Coipita project, located in the San Juan province of Argentina. AbraSilver is listed on the Toronto Stock Exchange under the symbol “ABRA” and in the U.S. on the OTCQX under the symbol “ABBRF.”

For further information please visit the AbraSilver Resource website at www.abrasilver.com, our LinkedIn page at AbraSilver Resource Corp., and follow us on X at www.x.com/abrasilver

Alternatively, please contact:

John Miniotis, President and CEO

[email protected]

Tel: +1 416-306-8334

Cautionary Statements

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. All statements that address future plans, activities, events or developments that the Company believes, expects or anticipates will or may occur are forward-looking information. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. When considering this forward-looking information, readers should keep in mind the risk factors and other cautionary statements in the Company’s disclosure documents filed with the applicable Canadian securities regulatory authorities on SEDAR+ at www.sedarplus.ca. The risk factors and other factors noted in the disclosure documents could cause actual events or results to differ materially from those described in any forward-looking information. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this news release