Toronto – February 21, 2023: AbraSilver Resource Corp. (TSX.V: ABRA; OTCQX: ABBRF) (“AbraSilver” or the “Company”) is pleased to announce an expansion of the ongoing Phase III drill program on the Company’s wholly-owned Diablillos property in Salta Province, Argentina (“Diablillos” or the “Project”).

The Phase III drill program is now expected to consist of approximately 22,000 metres of diamond drilling, up from 15,000 metres, using two diamond drill rigs. Phase III drilling is designed to delineate a maiden Mineral Resource estimate on the recently discovered JAC zone, located several hundred metres southwest of the conceptual open pit that constrains the current Mineral Resource estimate on the main Oculto deposit. Additional drill holes are required as mineralization at the JAC zone remains open in most directions.

To date, the Company has completed approximately 12,200 metres of drilling, in 60 holes, as part of the Phase III program. The expanded program is expected to be completed in July 2023, and will be followed by an updated Mineral Resource estimate (“MRE”) and a Pre-Feasibility Study (“PFS”) on the Diablillos project in Q4/2023.

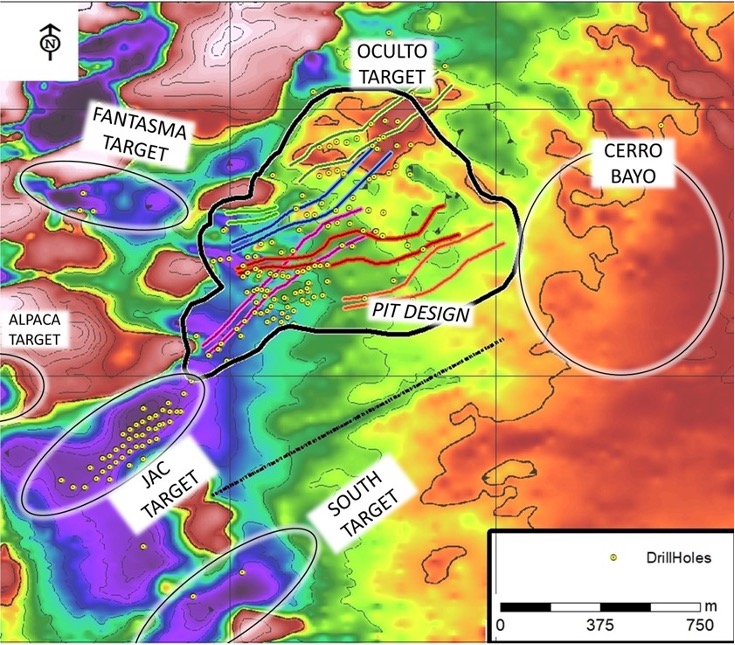

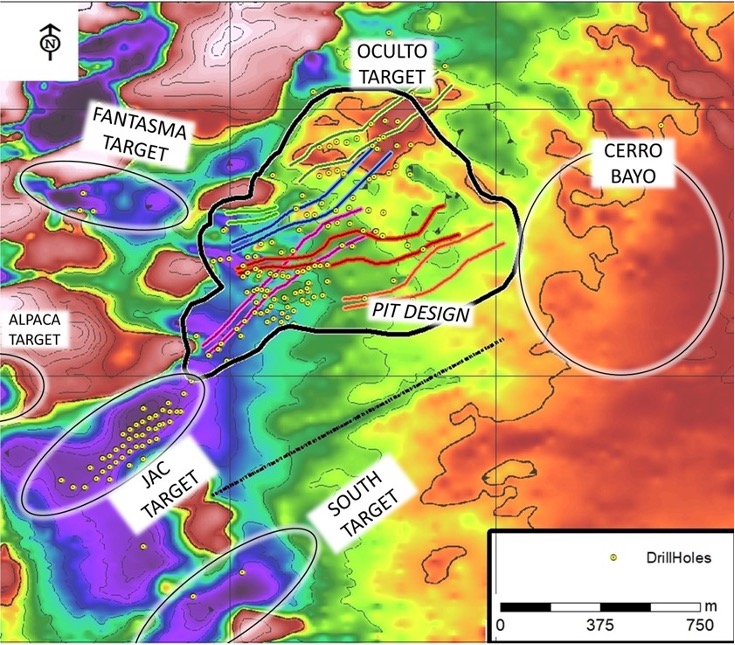

The main objectives of the expanded Phase III drill program are listed below (see Figure 1):

- Systematically drill off silver-dominant mineralisation at the JAC zone in order to estimate Measured and Indicated Mineral Resources that can be incorporated into the planned MRE and PFS.

- Delineate the margins of the JAC zone and conduct geotechnical drilling necessary for a conceptual open pit design.

- Potentially conduct reconnaissance drilling at other targets on the Diablillos land package, including Fantasma, Alpaca and the Southern Zone.

Additionally, the Company is pleased to announce the commencement of its second drill campaign at the La Coipita Project (“La Coipita”), located in the San Juan province of Argentina. Further details are provided in the ‘Commencement of Drilling at La Coipita Project’ section below.

John Miniotis, President and CEO, commented, “Our Phase III exploration program is continuing to provide us with excellent results on a very consistent basis, confirming the significant upside potential at our new JAC zone. To date, every hole drilled in the JAC target has successfully intersected near-surface, silver mineralization over substantial widths (see summary in Table 1, below). As we have not yet delineated the limits of mineralization at this impressive new silver discovery, we are excited to expand the size of our current drill program which we believe will lead to a significant Mineral Resource estimate at JAC. We expect the JAC target to significantly increase the silver in our MRE and have a meaningful impact on project economics, which will be estimated in the PFS anticipated in Q4.”

JAC Target - Exploration Update

The discovery hole at the JAC target was announced in August 2022. To date, assay results from 30 holes have been received in which multiple high-grade intercepts have been reported (see Table 1 below). Based on the highly encouraging results, the Company is expanding the Phase III drill program from 15,000 to 22,000 metres. The expanded drill program will have a total cost of approximately US$6.6 million, of which only US$3.0 million remains to be spent. The Company remains well-funded with a current cash balance of approximately CAD$15.0 million.

Table 1: JAC Target – Highlights of Phase III Intercepts Announced to Date

| Drill Hole |

From (m) |

To (m) |

Type |

Interval (m) |

Ag g/t

|

Au g/t |

AgEq1g/t |

| DDH-22-019 |

89 |

176 |

Oxides |

87.0 |

346.0 |

0.15 |

356.5 |

| DDH-22-044 |

121 |

179 |

Oxides |

58.0 |

208.8 |

0.20 |

222.8 |

| DDH-22-046 |

123 |

165.5 |

Oxides |

42.5 |

400.5 |

0.11 |

408.2 |

| DDH-22-052 |

139.5 |

164.5 |

Oxides |

25.0 |

754.4 |

0.12 |

764.2 |

| DDH-22-053 |

140.5 |

168.5 |

Oxides |

28.0 |

266.4 |

0.64 |

318.8 |

| DDH-22-056 |

110.0 |

167.5 |

Oxides |

57.5 |

141.4 |

0.27 |

163.5 |

| DDH-22-057 |

144.0 |

164.0 |

Oxides |

20.0 |

498.6 |

0.10 |

506.8 |

| DDH-22-058 |

138.0 |

152.5 |

Transition |

14.5 |

176.2 |

- |

176.2 |

| DDH-22-060 |

114.0 |

154.0 |

Oxides |

40.0 |

203.4 |

- |

203.4 |

| DDH-22-061 |

65.0 |

168.0 |

Oxides |

103.0 |

138.7 |

- |

138.7 |

| DDH-22-062 |

119.0 |

170.0 |

Oxides |

51.0 |

169.4 |

0.20 |

185.8 |

| DDH-22-063 |

56.0 |

85.0 |

Oxides |

33.0 |

143.4 |

- |

143.4 |

| DDH-22-063 |

135.0 |

169.0 |

Oxides |

34.0 |

118.6 |

0.08 |

125.2 |

| DDH-22-065 |

83.0 |

118.0 |

Oxides |

35.0 |

82.0 |

- |

82.0 |

| DDH-22-067 |

143.0 |

179.0 |

Oxides |

36.0 |

463.3 |

0.71 |

521.5 |

| DDH-22-067 |

179.0 |

206.0 |

Sulphides |

27.0 |

745.0 |

1.54 |

871.1 |

| DDH-22-072 |

92.0 |

122.0 |

Oxides |

30.0 |

73.2 |

0.12 |

83.0 |

| DDH-22-075 |

151.0 |

167.0 |

Oxides |

16.0 |

604.4 |

0.82 |

671.5 |

| DDH-22-076 |

147.0 |

169.0 |

Oxides |

22.0 |

476.8 |

0.20 |

493.2 |

| DDH-22-076 |

169.0 |

177.5 |

Oxides |

8.5 |

1,952.8 |

6.66 |

2,498.3 |

| DDH-22-077 |

60.0 |

92.0 |

Oxides |

32.0 |

121.9 |

- |

121.9 |

| DDH-22-078 |

58.0 |

99.0 |

Oxides |

41.0 |

103.5 |

- |

103.5 |

| DDH-22-079 |

144.0 |

179.0 |

Oxides |

35.0 |

199.2 |

0.36 |

228.7 |

| DDH-22-080 |

50.0 |

102.0 |

Oxides |

52.0 |

125.1 |

- |

125.1 |

| DDH-22-081 |

128.0 |

165.0 |

Oxides |

37.0 |

179.3 |

- |

179.3 |

| DDH-22-082 |

154.5 |

181.0 |

Transition |

26.5 |

311.4 |

0.43 |

346.6 |

Note: All results in this news release are rounded. Assays are uncut and undiluted. Widths are drilled widths, not true widths. True widths are estimated to be approximately 80% of the interval widths.

1AgEq based on 81.9(Ag):1(Au) calculated using long-term prices of US$25.00/oz Ag and US$1,750/oz Au, and 73.5% process recovery for Ag, and 86.0% process recovery for Au as demonstrated in the Company’s Preliminary Economic Assessment in respect of Diablillos dated January 13, 2022, using formula: AgEq g/t = Ag g/t + Au g/t x (Gold Price/Silver Price) x (Gold Recovery/Silver Recovery).

Figure 1 – Diablillos Plan Map Showing Magnetics (RTP), Recent Drill Holes & Exploration Targets

Updated Mineral Resource Estimate & Pre-Feasibility Study

While the maiden Mineral Resource estimate on the JAC target and the Diablillos PFS were originally planned to be completed in H1/2023, the additional drilling at JAC, which is expected to positively impact the economics of the project, will take longer than expected and will not be completed until July 2023. As a result, the updated MRE and PFS are now expected to be completed in Q4/2023 and will incorporate the assay results from the expanded 22,000m Phase III drill program.

The Company continues to progress key aspects of the PFS, including advancing additional metallurgical testwork, optimizing process design and engineering, equipment sizing, advancing renewable power generation alternatives, and updating capital and operating cost estimates with market-sourced quotations.

Commencement of Drilling at La Coipita Project

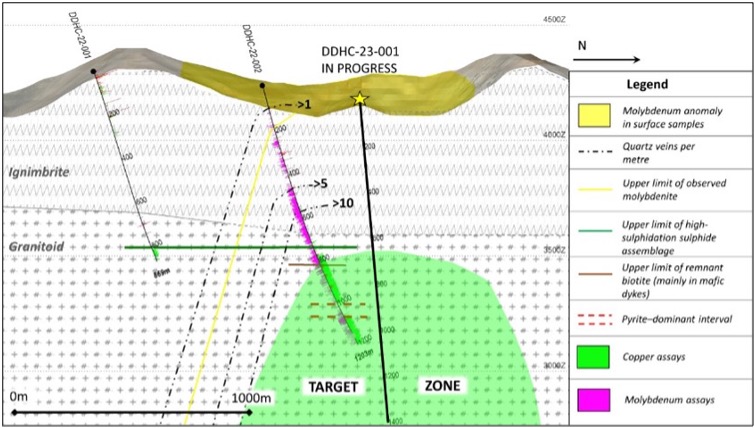

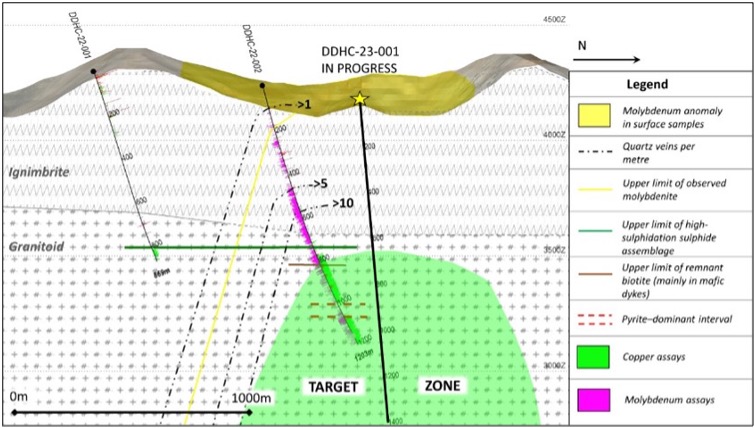

The La Coipita project is located in the San Juan Province, Argentina, in a geological setting similar to world-class deposits in the same belt, including the Filo del Sol and Los Azules projects, where porphyry style mineralisation is found immediately beneath epithermal mineralization.

On June 28, 2022, the Company announced the discovery of a significant new copper-gold-molybdenum porphyry system at La Coipita based on results from two initial deep drill holes. The discovery hole, DDHC 22-002, returned broad intervals of copper-gold-molybdenum porphyry mineralization including 226 metres grading 0.34% copper, 0.07 g/t gold and 66 ppm molybdenum. The hole also encountered a separate interval of 146 metres grading 0.27% copper and 75 ppm molybdenum, with the hole ending in mineralization at a down-hole depth of 1,202.5 metres.

This year’s follow-up drill campaign is expected to consist of one deep hole (approximately 1,400m), targeting the anticipated higher-grade zone of the porphyry system intercepted in hole DDHC 22-002. Drilling has now commenced and is expected to be completed in April 2023. Quartz-veinlet intensity (from 1 to >10 per m) and presence of molybdenum (as molybdenite) indicate a potential dome-like feature that is believed to likely be centred above the deeper copper system and will be targeted by this year’s drilling (Figure 2).

Figure 2 – La Coipita Drill Section

Incentive Stock Option Grant

The Company announces, that pursuant to the Company’s Share Compensation Plan and regulatory approval, an aggregate of 5,725,000 incentive stock options (“Options”), exercisable at a price of $0.37 per share for a period of five years, has been granted to officers, directors, employees and consultants of the Company. The Options vest in 25% instalments every 6 months, starting from the date of the grant.

Qualified Persons

David O’Connor P.Geo., Chief Geologist for AbraSilver, is the Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, and he has reviewed and approved the scientific and technical information in this news release.

QA/QC and Core Sampling Protocols

AbraSilver applies industry standard exploration methodologies and techniques, and all drill core samples are collected under the supervision of the Company’s geologists in accordance with industry practices. Drill core is transported from the drill platform to the logging facility where drill data is compared and verified with the core in the trays. Thereafter, it is logged, photographed, and split by diamond saw prior to being sampled. Samples are then bagged, and quality control materials are inserted at regular intervals; these include blanks and certified reference materials as well as duplicate core samples which are collected in order to measure sample representivity. Groups of samples are then placed in large bags which are sealed with numbered tags in order to maintain a chain-of-custody during the transport of the samples from the project site to the laboratory.

All samples are received by the SGS offices in Salta who then dispatch the samples to the SGS preparation facility in San Juan. From there, the prepared samples are sent to the SGS laboratory in Lima, Peru where they are analyzed. All samples are analyzed using a multi-element technique consisting of a four acid digestion followed by ICP/AES detection, and gold is analyzed by 50g Fire Assay with an AAS finish. Silver results greater than 100g/t are reanalyzed using four acid digestion with an ore grade AAS finish.

For additional information regarding Mineral Resources please see Technical Report on the Diablillos Project, Salta Province, Argentina, dated November 28, 2022, completed by Mining Plus, and available on www.SEDAR.com.

About AbraSilver

AbraSilver is an advanced-stage exploration company focused on rapidly advancing its 100%-owned Diablillos silver-gold project in the mining-friendly Salta province of Argentina. The current Measured and Indicated Mineral Resource estimate for Diablillos consists of 51.3 Mt grading 66g/t Ag and 0.79g/t Au, containing approximately 109Moz silver and 1.3Moz gold, with significant further upside potential based on recent exploration drilling. The Company is led by an experienced management team and has long-term supportive shareholders including Mr. Eric Sprott. In addition, AbraSilver owns a portfolio of earlier-stage copper-gold projects including the La Coipita copper-gold project in the San Juan province of Argentina. AbraSilver is listed on the TSX-V under the symbol “ABRA” and in the U.S. under the symbol “ABBRF”.

For further information please visit the AbraSilver Resource website at www.abrasilver.com, our LinkedIn page at AbraSilver Resource Corp., and follow us on Twitter at www.twitter.com/abrasilver

Alternatively please contact:

John Miniotis, President and CEO

[email protected]

Tel: +1 416-306-8334

Cautionary Statements

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. All statements that address future plans, activities, events or developments that the Company believes, expects or anticipates will or may occur are forward-looking information. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. When considering this forward-looking information, readers should keep in mind the risk factors and other cautionary statements in the Company’s disclosure documents filed with the applicable Canadian securities regulatory authorities on SEDAR at www.sedar.com. The risk factors and other factors noted in the disclosure documents could cause actual events or results to differ materially from those described in any forward-looking information. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release