Toronto – June 01, 2023: AbraSilver Resource Corp. (TSX.V: ABRA; OTCQX: ABBRF) (“AbraSilver” or the “Company”) is pleased to report positive preliminary metallurgical test results for the new JAC zone at its wholly-owned Diablillos property in Salta Province, Argentina (“Diablillos” or the “Project”). The program was completed by independent metallurgical consultants, SGS Canada Inc., at their testing facilities in Lakefield, Ontario.

Key Highlights Include:

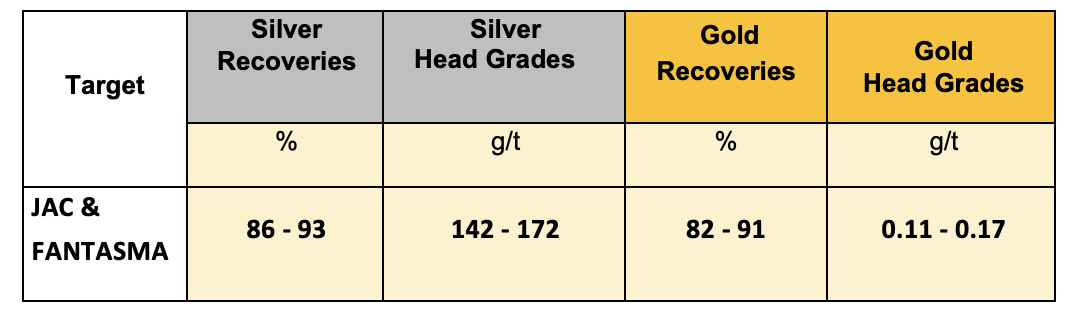

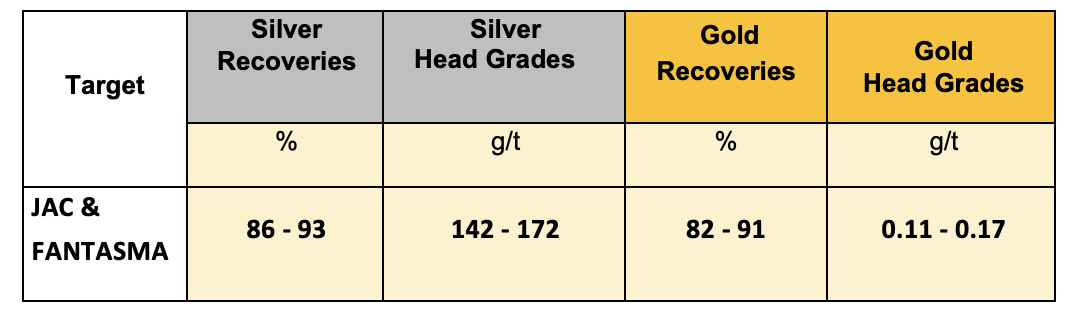

- Overall recoveries at the JAC and Fantasma deposits range between 86% - 93% for silver and 82% - 91% for gold.

- A substantial percentage of the silver at JAC can be recovered by gravity separation which increases overall recoveries.

- Current testwork confirms that the same process flowsheet can be used to process mineralization from the Oculto, JAC and Fantasma deposits.

- Milling tests have shown that 150 microns is the targeted grind size for the leaching of the mineralized material at a retention time of 36 hours.

- Overall silver and gold recoveries could likely be increased further by grinding finer and with higher cyanide concentrations. Further metallurgical testwork and trade-off studies are now underway.

John Miniotis, President and CEO, commented, “We are extremely pleased that the metallurgical testwork results at JAC demonstrate excellent recovery rates for both silver and gold. These results show that mineralization at JAC responds very well to conventional processing and recovery technologies, providing highly positive implications for the future development potential of the project. The results will be incorporated into our Mineral Resource estimate and Pre-Feasibility Study which remain on track to be delivered later this year.”

Favorable Recovery Rates vs. Prior Testwork

At the JAC and Fantasma deposits the silver minerals (chlorargyrite and iodargyrite) are easier to release by grinding, and are more sensitive to cyanide leaching as they occur in argillic alteration, whereas at Oculto they are mostly held more complexly in vuggy silica host rock.

Table 1 - Summary of Metallurgical Testwork Results for JAC and Fantasma Deposits

Testwork on JAC and Fantasma samples showed that gravity separation before cyanide leaching recovers approximately 9% of the silver and 17% of the gold which, when combined with the subsequent cyanide leaching recoveries, results in total overall recoveries of between 86% and 93% for silver and between 82% and 91% for gold.

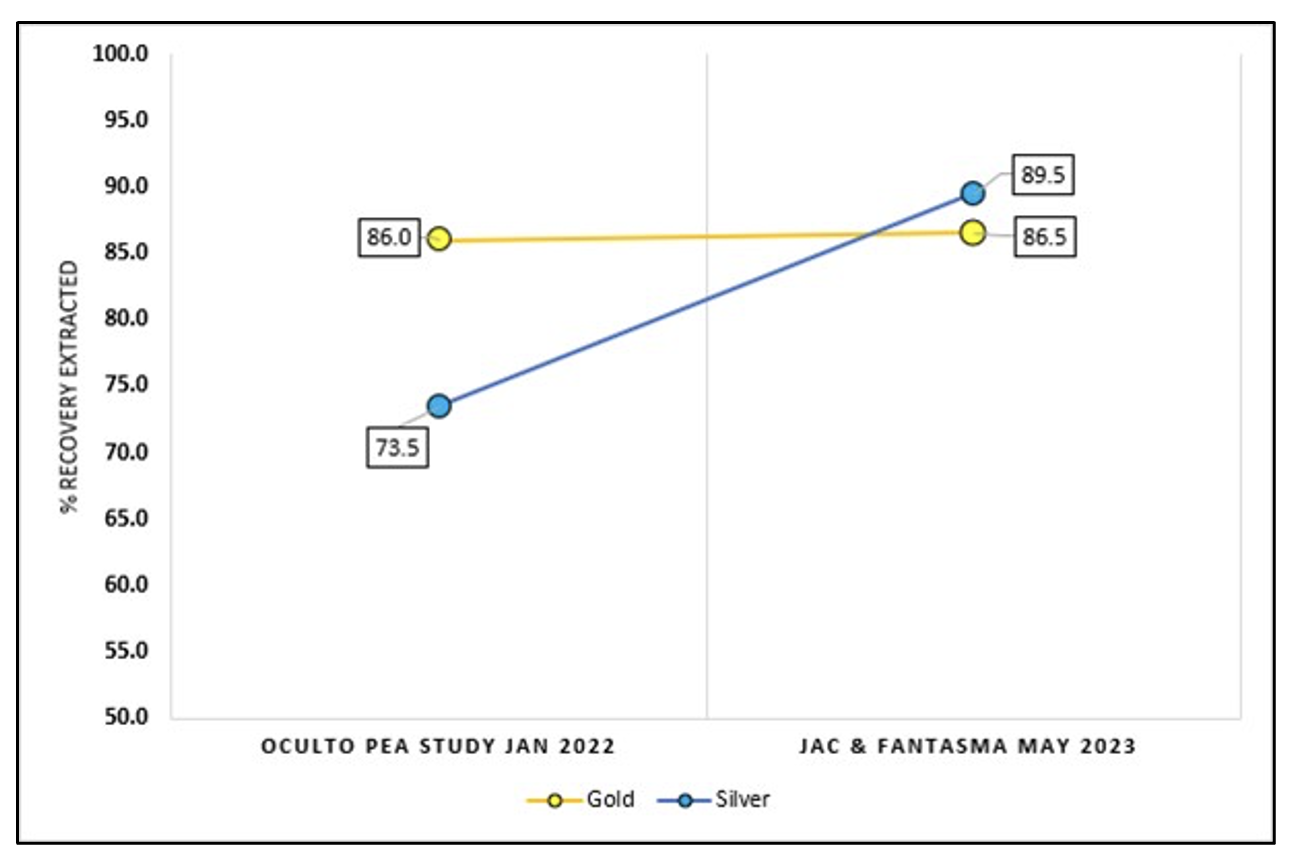

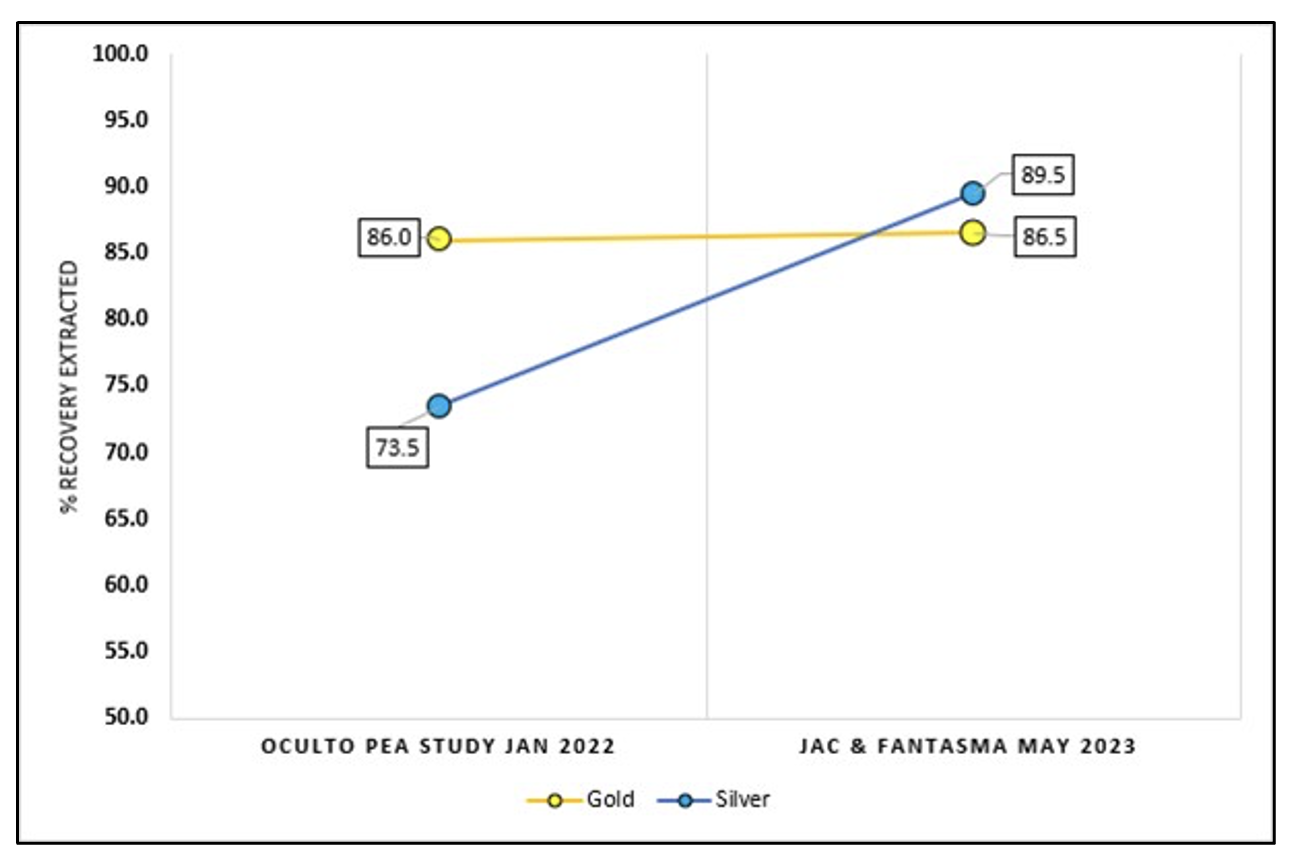

Table 2 below shows gravity plus cyanide leach recoveries at the JAC and Fantasma deposits compared with the Oculto deposit recoveries announced in the PEA announced in January 2022.

Table 2 – Latest Metallurgical Testwork Results vs. Jan. 2022 PEA Study

| Recoveries |

JAC & Fantasma (May 2023) |

Oculto PEA Study (Jan.2022)1 |

| Gold |

82%-91% |

86.0% |

| Silver |

86%-93% |

73.5% |

| Comments |

Gravity + Cyanidation |

Cyanidation Only |

1Recovery rates for Oculto PEA reflect the life of mine average as per the report published on Jan. 13, 2022 titled “NI 43-101 Preliminary Economic Assessment Technical Report – Diablillos Project”

A median of 89.5% recoveries for silver and 86.5% for gold at JAC and Fantasma compare favourably against the 73.5% silver recoveries and 86.0% gold recoveries used for the Preliminary Economic Assessment (“PEA”) at Oculto. The median silver recovery of 89.5% relative to 73.5% for Oculto is particularly relevant because the mineralization at the JAC and Fantasma deposits is predominantly silver.

Figure 1 – Median Recoveries at the JAC & Fantasma Deposits Compared with the Oculto Deposit

JAC drill core samples for metallurgical testing were selected to be volumetrically representative of the mineralised system, being from the various zones of mineralisation along strike and at depth, including high, medium and lower grades. Care was taken not to mix alteration zones so that geo-metallurgical domains can be determined.

Additional metallurgical testing is being conducted on samples from different geo-metallurgical domains at Oculto in an effort to boost overall recoveries, especially from areas with high silver grades.

Metallurgical Test Program Overview

This campaign was the first metallurgical testwork program conducted on the new JAC zone, discovered in August 2022, and on the already known Fantasma deposit. Work completed involved comminution, gravity, leaching and thickening testwork of fourteen variability composites with twelve from the JAC zone and two from the Fantasma zone. The results will be incorporated in the upcoming Mineral Resource estimate (“MRE”) update and Pre-Feasibility Study (“PFS”) for the overall Diablillos project.

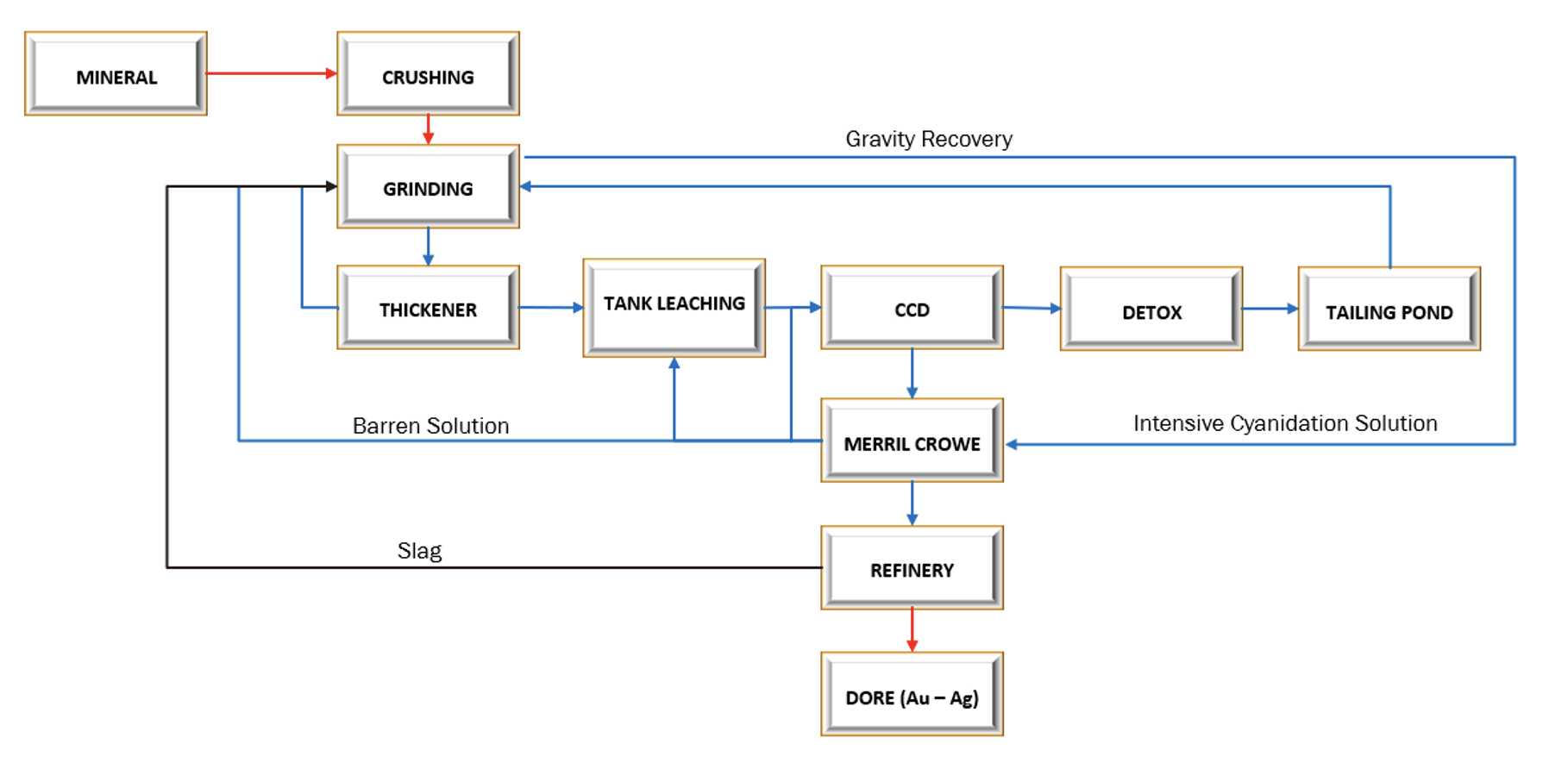

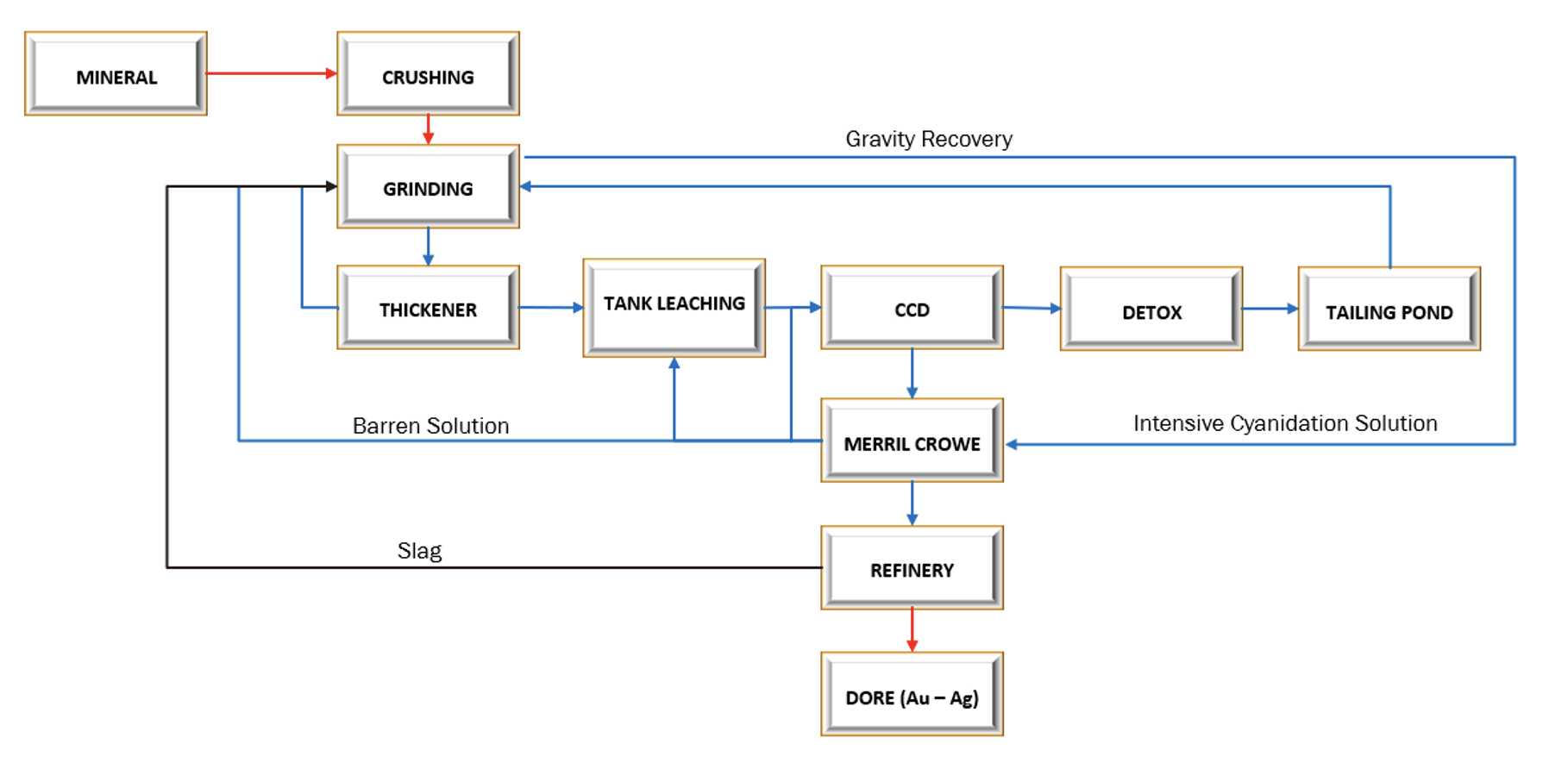

The results confirm that the Diablillos project will have a conventional silver/gold processing plant flowsheet incorporating crushing, grinding, gravity concentration and intense cyanidation circuit, cyanide leaching with oxygen addition, counter current decantation (“CCD”) washing thickeners and Merrill-Crowe precious metal recovery from solution followed by on-site smelting to doré bars.

A summary of the processing flow sheet for the Diablillos project is shown below.

Figure 2 – Simplified Process Flowsheet for the Diablillos Project

- Bulk mineralogical investigation determined that quartz, alunite, and iron-oxides were the major mineral components of the samples, and it is demonstrated that most of the silver will respond well to direct cyanidation. The JAC composite was used for most of the testing program, with average head grades of 0.11 g/t gold and 148 g/t silver.

- Response to standard gravity separation tests for the recovery of free silver and gold resulted in average recoveries of 9% and 17%, respectively. As a result, the overall gravity plus cyanidation recoveries achieved were 86% to 93% for silver and 82% to 91% for gold.

- The following optimum whole ore cyanidation conditions were established for the JAC composite and applied to the variability samples:

- Grind size P80 of 150 μm,

- 45% pulp density (w/w),

- pH of 10.5-11.0 (maintained with lime),

- 4 hours of pre-aeration with air sparging,

- air-sparging during leaching,

- Sodium cyanide (NaCN) concentration of 1.5 g/l maintained for the first 12 hours of leaching and then allowed to naturally decay for the remaining leach time.

- The testwork showed that silver and gold recoveries could likely be further increased by grinding finer (P80 of 70 μm versus 150 μm) and by increasing cyanide consumption from 1.5 g/l to 2.5 g/l. Further metallurgical testwork and trade-off studies will be conducted to confirm the optimum process route.

- Environmental assessment of the leach tailings samples showed the potential for acid generation in some samples. On-site humid cell testwork is planned and mitigating measures will be designed as part of the tailings management strategy.

- Settling/thickening and rheology tests were performed on the JAC composite cyanide leach and cyanide destruction residue, showing a fast-settling rate in response to tested flocculants. Counter Current Decantation (CCD) modelling was performed as well, resulting in a 4 stages CCD circuit producing a final wash efficiency of 99.8%

Future Work Programs

- Cyanide leach tests will continue on the samples from Oculto, JAC and Fantasma to optimize recovery and leach time. Drivers to improve recoveries will include stronger cyanide solutions, grind size of the ore, and leaching residence times.

- As gravity separation was successful in concentrating gold and silver at the JAC deposit, it is proposed that additional testing of gravity separation in advance of cyanidation be carried out on mineralisation types at Oculto, where there are both gold and silver dominant geo-metallurgical zones.

- At the Diablillos site, humid cell test work is ongoing to evaluate acid rock drainage generation from the cyanidation tailings under site conditions to support potential mitigating measures in the tailings management strategy.

- Heap leaching test work will be conducted to investigate the possibility of recovering lower grade material.

About Diablillos

The 80 km2 Diablillos property is located in the Argentine Puna region - the southern extension of the Altiplano of southern Peru, Bolivia, and northern Chile - and was acquired from SSR Mining Inc. by the Company in 2016. There are several known mineral zones on the Diablillos property, with the Oculto zone being the most advanced with over 120,000 metres drilled to date. Oculto is a high-sulphidation epithermal silver-gold deposit derived from remnant hot springs activity following Tertiarty-age local magmatic and volcanic activity. Comparatively nearby examples of high sulphidation epithermal deposits include: Yanacocha (Peru); El Indio (Chile); Lagunas Nortes/Alto Chicama (Peru) Veladero (Argentina); and Filo del Sol (Argentina).

The most recent Mineral Resource estimate for the Oculto Deposit is shown in Table 3:

Table 3 - Oculto Mineral Resource Estimate – As of October 31, 2022

| Category |

Tonnage

(000 t)

|

Ag

(g/t)

|

Au

(g/t)

|

Contained Ag

(000 oz Ag)

|

Contained Au

(000 oz Au)

|

| Measured |

19,336 |

98 |

0.88 |

60,634 |

544 |

| Indicated |

31,978 |

47 |

0.73 |

48,737 |

752 |

| Measured & Indicated |

51,314 |

66 |

0.79 |

109,370 |

1,297 |

| Inferred |

2,216 |

30 |

0.51 |

2,114 |

37 |

Notes: Effective October 31, 2022. Mineral Resources are not Mineral Reserves and have not demonstrated economic viability. The Mineral Resource estimate is N.I. 43-101 compliant and was prepared by Luis Rodrigo Peralta, B.Sc., FAusIMM CP(Geo), Independent Consultant. The mineralization estimated in the Mineral Resource is sub-horizontal with sub-vertical feeders and a reasonable prospect for eventual economic extraction by open pit methods. For additional information please see Technical Report on the Diablillos Project, Salta Province, Argentina, dated November 28, 2022, completed by Mining Plus, and available on www.SEDAR.com.

QA/QC and Core Sampling Protocols

AbraSilver applies industry standard exploration methodologies and techniques, and all drill core samples are collected under the supervision of the Company’s geologists in accordance with industry practices. Drill core is transported from the drill platform to the logging facility where drill data is compared and verified with the core in the trays. Thereafter, it is logged, photographed, and split by diamond saw prior to being sampled. Samples are then bagged, and quality control materials are inserted at regular intervals; these include blanks and certified reference materials as well as duplicate core samples which are collected in order to measure sample representivity. Groups of samples are then placed in large bags which are sealed with numbered tags in order to maintain a chain-of-custody during the transport of the samples from the project site to the laboratory.

All samples are received by the SGS offices in Salta who then dispatch the samples to the SGS preparation facility in San Juan. From there, the prepared samples are sent to the SGS laboratory in Lima, Peru where they are analyzed. All samples are analyzed using a multi-element technique consisting of a four-acid digestion followed by ICP/AES detection, and gold is analyzed by 30g Fire Assay with an AAS finish. Silver results greater than 100g/t are reanalyzed using four acid digestion with an ore grade AAS finish. Analytical results are statistically processed for final acceptance.

Qualified Persons

David O’Connor P.Geo., Chief Geologist for AbraSilver, is the Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, and he has reviewed and approved the scientific and technical information in this news release.

About AbraSilver

AbraSilver is an advanced-stage exploration company focused on rapidly advancing its 100%-owned Diablillos silver-gold project in the mining-friendly Salta province of Argentina. The current Measured and Indicated Mineral Resource estimate for Diablillos consists of 51.3 Mt grading 66g/t Ag and 0.79g/t Au, containing approximately 109Moz silver and 1.3Moz gold, with significant further upside potential based on recent exploration drilling. The Company is led by an experienced management team and has long-term supportive shareholders including Mr. Eric Sprott. In addition, AbraSilver owns a portfolio of earlier-stage copper-gold projects including the La Coipita copper-gold project in the San Juan province of Argentina. AbraSilver is listed on the TSX-V under the symbol “ABRA” and in the U.S. under the symbol “ABBRF”.

For further information please visit the AbraSilver Resource website at www.abrasilver.com, our LinkedIn page at AbraSilver Resource Corp., and follow us on Twitter at www.twitter.com/abrasilver

Alternatively please contact:

John Miniotis, President and CEO

[email protected]

Tel: +1 416-306-8334

Cautionary Statements

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. All statements that address future plans, activities, events or developments that the Company believes, expects or anticipates will or may occur are forward-looking information. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. When considering this forward-looking information, readers should keep in mind the risk factors and other cautionary statements in the Company’s disclosure documents filed with the applicable Canadian securities regulatory authorities on SEDAR at www.sedar.com. The risk factors and other factors noted in the disclosure documents could cause actual events or results to differ materially from those described in any forward-looking information. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release